Payment Terms Rule Setup

Navigate:  Tax

> Accounts Receivable >

Payment Terms Mapping

and Setup > Payment Terms Rule Setup

Tax

> Accounts Receivable >

Payment Terms Mapping

and Setup > Payment Terms Rule Setup

Description

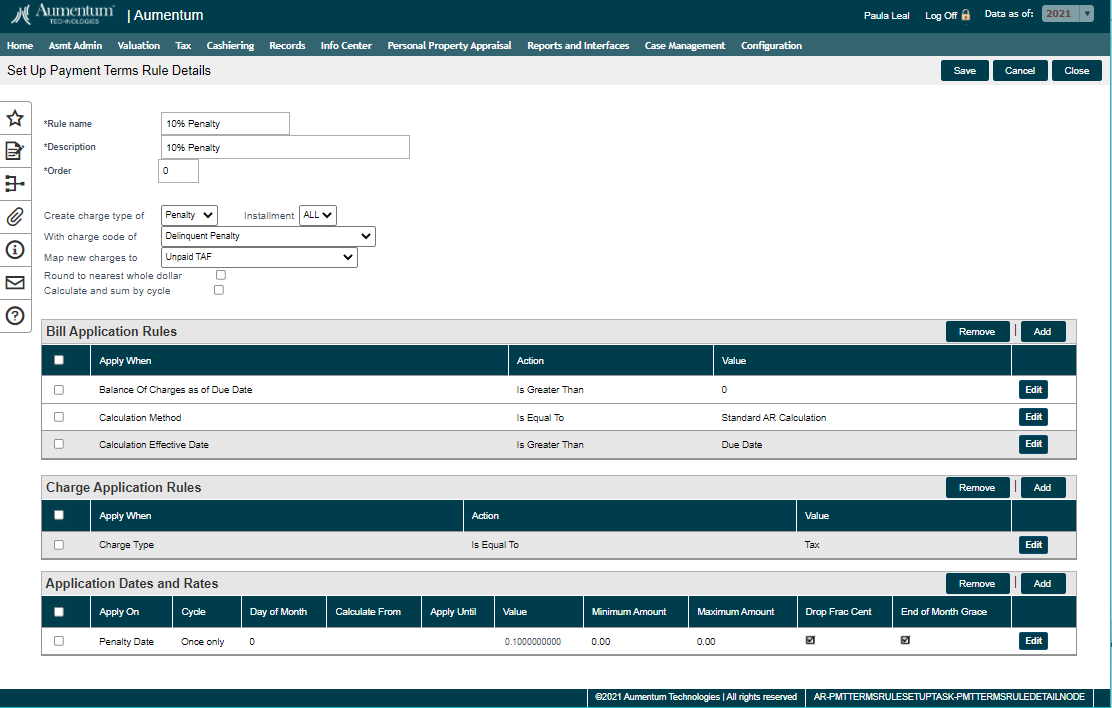

Set up the mappings for penalty, interest, discounts, or any other charges, collectively known as "payment terms" or "payment rules," using a series of screens to define all aspects of the rates, calculation and application of all payment terms.

Payment terms are defined at initial setup. Thereafter, they are changed only as needed when a rule, rate, date or other aspect of the payment rule has changed.

IMPORTANT: Correct effective dates are critical for the payment terms setup. The effective date of the earliest rates should be set back earlier than any possible tax bills that would need calculation of applied payment terms. Each change to a rate over the course of time must have the corresponding effective date change for its setup.

Jurisdiction

Specific Information

Jurisdiction

Specific Information

California

-

506 Interest Calculation. Payment Terms Rule Setup includes Assessment Administration value type as a criteria to support 506 interest calculation.

-

The Bill Application Rules panel on the Set Up Payment Terms Rule Details screen (Tax > Accounts Receivable > Payment Terms Mapping and Setup > Payment Terms Rule Setup > Search for Payment Terms Rules > [Add or Edit] > Set Up Payment Terms Rule Details) links to Value Criteria (AA > Setup > Value Criteria) so that the Value Type for 503/504 can be selected as part of the criteria to define whether the bill is eligible for 506 interest. Payment Terms Rules has been set up with a Charge Type of Interest and a unique charge code.

-

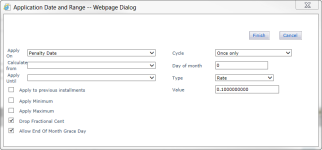

Accounts Receivable passes the amount to Levy, and Levy writes the 506 Interest as Charge Type = Tax but with a unique Charge Code/Subcode. A new Cycle method in the Application Dates and Rates panel of the Set Up Payment Terms Rule Details screen allows proration and calculation of a portion of a month multiplied by the monthly rate.

-

Specific interest is passed back to Assessment Administration/Levy for inclusion in the bill charges from Levy. In addition, The Levy functional calendar periods include the original delinquent date, populated by Levy, so that it can be used as the start date for 506 interest. Also, Interest End Date was added. This is the date the additional assessment was added to assessment roll and has been added to the periods in the functional calendar. The Payment Terms Rule for 506 interest exclude Special Assessment tax charges.

-

NOTE: See Jurisdiction Specific Information about defining Bill Application Rules on the Set Up Payment Terms Rule Details screen for this setup when the tax bill is the most recent bill in the Tax Sale Agency.

Steps

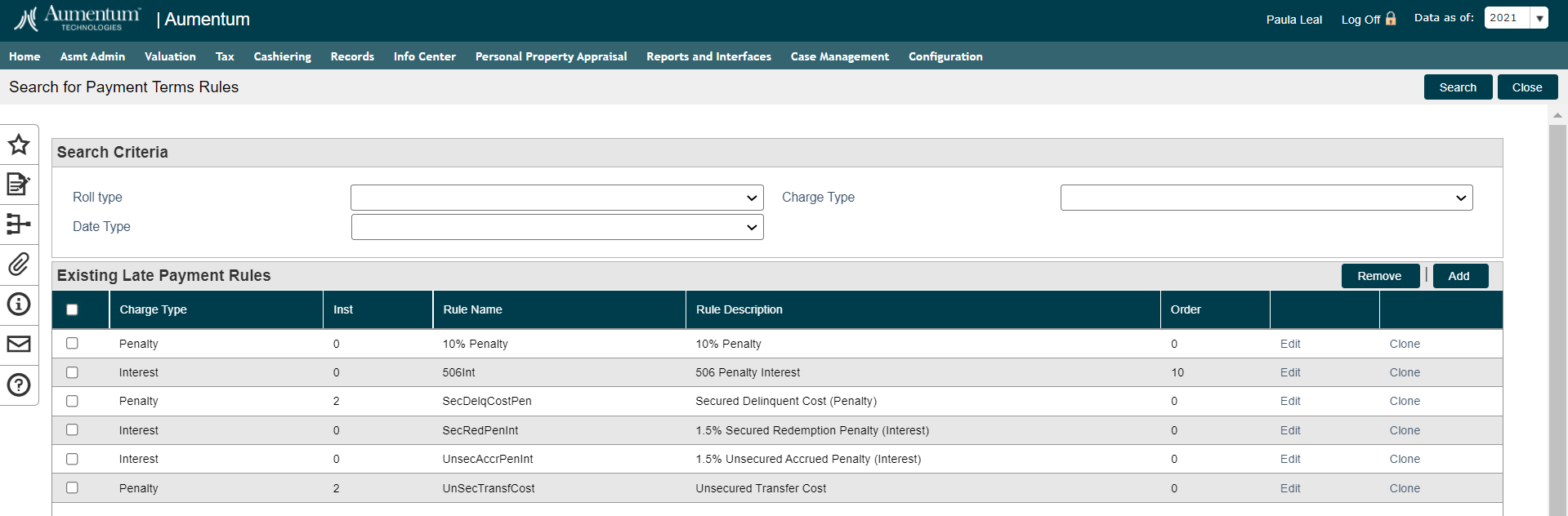

- On the Search for Payment Terms Rules screen, enter your search criteria and click Search.

- On the Set Up Payment Terms Rule Details screen, enter a Rule Name, Description, and Order in the header area.

- Make a selection from the drop-down lists and select each checkbox if applicable.

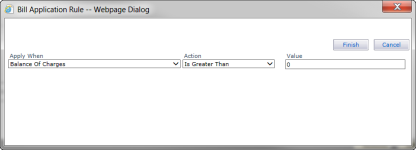

- In the Bill Application Rules panel, click Add or click Edit for an existing item in the grid.

- In the Bill Application Rule pop-up, make a selection from the drop-down lists and enter a value. Click Finish.

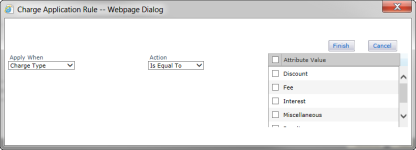

- In the Charge Application Rules panel, click Add or click Edit for an existing item in the grid.

- In the Charge Application Rule pop-up, make a selection from the drop-down lists, and select an attribute value. Click Finish.

- In the Application Dates and Rates panel, click Add or click Edit for an existing item in the grid.

- Click Save in the Command Item bar.

OR

Click Edit for an item in the Existing Late Payment Rules panel.

OR

Click New.

Prerequisites

A/R

-

Manage Payment Terms Mappings – Distribution - Used in Set Up Late Payment Rule Details.

Configuration Menu

-

Functional Calendar – Calendar dates must be previously set up.

-

Systypes

Set up the for the systype category Penalty/Interest Cycle

Set up the systypes for the Functional Calendar Event Types.

Levy Management Module

-

Installment Schedules – Set up installments.

Dependencies

Accounts Receivable

-

Payment Terms Rule Groups – This setup defines the dates and circumstances for applying the rules. The late payment rule groups and setup provide the basis for late payment rule calculation.

NOTE: Each rule must be included in a late payment rule group in order to be considered during calculations.